Things You Need to Know

- Gov’t shutdown? Don’t be ridiculous – Stocks push higher.

- OpenAI – sparks even more interest in anything TECH.

- CAT – emerges as a winner in this game – You can teach old dog’s new tricks.

- Bonds Up, Yields Down, Oil continues to decline while Gold hovers at highs.

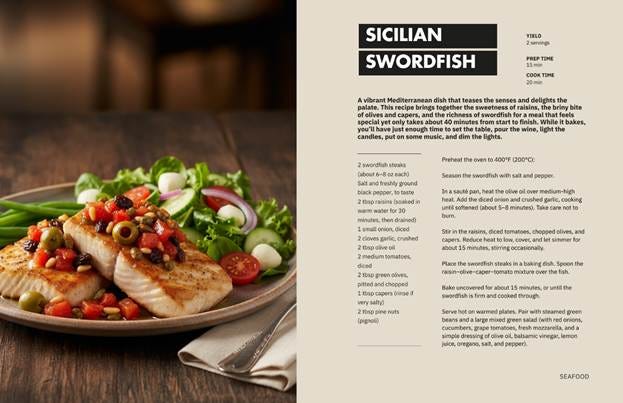

- Try the Swordfish Siciliana

And the good times keep rolling…. stocks continued their unprecedented run…. refusing to take even just on breath – investors unfazed by the shutdown and in fact the ‘prediction markets’ don’t’ think this will end until sometime after next week. …..

At the end of the day – The Dow up 78 pts, the S&P up 4, the Nasdaq up 89 pts, the Russell gained 16, the Transports added 95 pts, the Equal Weight S&P up 17, while the Mag 7 surprised everyone, losing 161 pts – the losses in TSLA -5.1% and MSFT – 0.8% overwhelming the gains in META, AMZN, AAPL, NVDA & GOOG.

OpenAI’s recent share sale giving it a $500 billion valuation only fanning the flames of excitement for ‘almost’ anything tech…..and then the excitement here is rolling over into stocks that you would not necessarily connect directly to AI…but it is happening….the latest name to enjoy the spotlight is none other than an ‘old line industrial company’ (think 1925) – one that does not necessarily scream ‘revolution’, but is now front and center of the action.

CAT – up 35% ytd and up 20% in the last month is the latest name to enjoy the excitement and emerge as an ‘unlikely’ winner in the game……You see, it doesn’t look like a direct connection, but it is….CAT manufactures construction and mining equipment and they also manufacture natural gas engines and turbines…..along with a long list of other things….. So here is the link – investors are betting that the massive AI demand for electricity and processing power means that Caterpillars ‘turbines’ are going to be in BIG demand – to help produce all of this electricity needed to run all the AI….….

Now recall how yesterday we highlighted Utilities – up 16.4% ytd – outperforming the broader market because of their role in being steady suppliers of the energy needed to power the data centers – and who is going to provide the turbines that help to create the electricity that the utility companies need? BINGO! CAT!

But there are other names in the sector, and they include ASTE +44%, Hitachi + 35%, Hyundai + 116% along with a few others..

In addition – the Metals & Miners are up big as well – the XME is up 70% ytd….and CAT makes mining equipment as well. Now recall, the Trump administration added 6 new commodities to the Critical Minerals List – and they all need to be ‘mined’…..See how this works? Everyone is in bed with everyone and apparently all having a ‘ball’!

Now what is interesting – is that of the 11 broad S&P sectors only 3 ended the day higher…..Basic Materials up 1.2%, Tech + 0.5% and Industrials +0.25%. The other 8 sectors were lower, led by Energy – 1% (oil fell another 1.8%), Consumer Discretionary down 0.7%, Real Estate – 0.5%, Consumer Staples – 0.4%, Communications, Healthcare & Utilities down 0.2% while Financials ended the day down 0.1%.

As you can imagine – Disruptive Tech – ARKK + 2.6%, Cyber + 0.7%, Semi’s + 2%, Robotics/AI up 1.7%, Next Gen Internet Services was up 2% and Quantum is another sector that just won’t stop…..RGTI + 18%, QBTS +14%, IONQ +10% and that is just yesterday – yearly performance is off the charts at +131%, +274%, +66% respectively.

Bonds rose – the TLT and TLH up 0.3% and 0.25% respectively. 10 yr yields are now yielding 4.08% while the 30 yr is yielding 4.68%…. both down off their recent highs. The 30 yr is now below 4.7% and this is KEY – watch the September 30th low at 4.67%…should we break that – then that puts the September 17th low (4.6%) in play….

Fed Fund futures are pricing in those 2 additional rate cuts this year – 25 bps in October and 25 bps in December – this vs. the 50 bps that Stevey Miran wants now.

Lorie Logan – President of the Dallas Fed and currently a non-voting member – has a reputation as a pragmatist: data-driven and not prone to overreacting.

In a speech yesterday, she struck a cautious tone on further interest-rate cuts following the Fed’s September move. She characterized that cut as “insurance” against the risk of a sharp deterioration in the labor market, but emphasized that the economy’s slowdown has been gradual. Inflation, she noted, remains “stubbornly” above the 2% target, while the job market is still resilient. She said that ‘easing too much will force a painful correction later…’

What’s interesting here is that she’s still publicly pointing to 2% as the goal – even though it feels increasingly clear the Fed has quietly accepted 3% as the new normal. After all, inflation is sitting at 3% and yet the Fed is in rate-cutting mode. That says a lot about where the real target may be.

Oil – as noted – fell by 1.8% yesterday and is now trading at $60.87. We have now broken the August and September lows of $61.20 – so $60 is next – Analysts are targeting the mid $50’s as a settlement price when this is over….The weakness is all about the increase in production out of Saudi Arabia (OPEC+) as well as the idea of a supply glut in early 2026…..In any event – lower oil prices will be a boon for consumers and businesses.

Gold is holding steady at all-time highs – as markets wait for an end to the shutdown…. that is doing nothing but causing more uncertainty. This morning it is up $8 at $3,864/oz.

US futures are guess what? Higher! Dow futures are up 117 pts, S&P’s up 20, the Nasdaq up 70 while the Russell is up 12. We will not get the monthly NFP report today due to the shutdown…which makes me want to ask –

Did they force a shutdown because the data would have been so weak (just like the ADP report) that it would have caused a bit of panic? Essentially, they didn’t want to release it. Or am I just being a ‘conspiracy theorist’? I guess we’ll find out at some point…. because it will have to come out….

As noted – the prediction markets don’t think this ends until the week of the 12th….Earnings start officially on the 14th – with the big banks….(JPM, C, WFC, etc.….) – although PEP & DAL – both big companies but NOT Dow companies like JPM – report on the 9th. Word is that analysts are bracing for a weak PEP report… and a ‘cautiously optimistic’ DAL report.

The September CPI is due out on the 15th and the PPI on the 16th. But if the government is still shut down by then, we won’t get the latest inflation data — and that’s going to spark all kinds of chatter about what the Fed should do next.

Here’s my take: you can’t convince me that the Fed won’t know what the NFP report looks like, even if we don’t. They’re the ones setting policy. I simply don’t believe they’d be flying blind without access to that data — shutdown or not.

European markets are all teasing recent highs…. Aerospace and Defense stocks in the spotlight as the Eurozone discusses building a ‘drone wall’ to deter Russian aircraft from violating their airspace. Italy’s AVIO is leading the gains up 3.5% on the day. In Switzerland – inflation is subsiding – the latest CPI report showed a contraction of 0.2% from the August report.

The S&P closed at 6,715 up 4 points – closing again at another new 2025 high. Futures this morning are suggesting its gonna be another ‘winner’ as we move into the end of the week. With little to no new eco data being reported – the focus will be on DC and what they are doing vs. what they are NOT doing. In any event – Enjoy the ride!

Here’s your new countdown:

11 days until earnings season kicks off.

26 days until the next Fed decision.

52 days until Black Friday — though you can expect “pre-Black Friday” sales to start popping up any day now.

And only 83 days until Christmas.

Let’s review your plan. Call me for a complimentary, no-obligation portfolio analysis: 561-931-0190.

Take good care,

Sources: Bloomberg, CNBC, Reuters, Wall Street Journal

Disclosure: The content provided in this material is designed for educational and informational purposes only, and it is important to note that it does not constitute personalized recommendations. This commentary is not nor is it intended to be relied upon as authoritative or taken in substitution for the exercise of judgment. The comments noted herein should not be construed as an offer to sell or the solicitation of an offer to buy or sell any financial product, or an official statement or endorsement of Kenny Polcari or SlateStone Wealth.

The market commentary is the opinion of the author and is based on decades of industry and market experience; however, no guarantee is made or implied with respect to these opinions, which may not necessarily align with our firm’s standpoint.

While considerable effort has been invested to ensure the accuracy and dependability of the information presented, we must clarify that we cannot guarantee the accuracy of third-party information. Our usual sources for third-party data include channels such as Bloomberg.

Swordfish Siciliana – Another page out of my soon to be ‘cookbook.’

Buon Appetito!